Quarterly Market Review: Q1 2022

By: Paul Dickson, Director of Research and Mark Stevens, Chief Investment Officer

The Reemergence of Risk

If there was one overarching theme to the first quarter of this year, it was that risks, which seemed vanquished in an earlier era, have returned to plague us. With Russia’s invasion of Ukraine, a war is once again afflicting Europe. The prospects of returning to a world of divided spheres of influence and a retreat from globalization appear to be increasing.

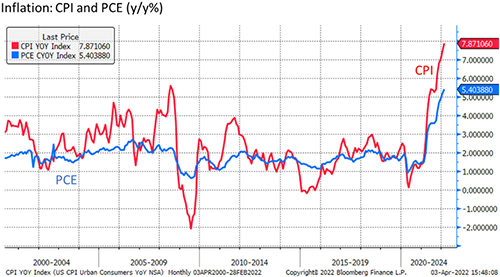

Inflation once seemed so well conquered that developed market Central Banks strained to lift price increases to meet targets and battled desperately against deflation, has returned with a vengeance and threatens to become entrenched. While inflation is threatening future growth prospects, the recent pace of economic activity and job creation has been astonishing; if likely unsustainable. The return of these risks has repriced the bond markets and taken some of the exuberance from equities. This seeming reset has been disconcerting and may pose additional downside pressures, and yet ultimately present opportunities over time.

The End of The End of History

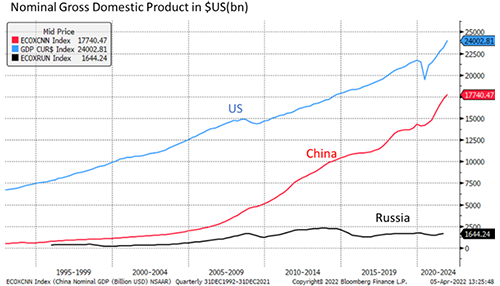

In 1989, Francis Fukuyama wrote a much-discussed essay, The End of History. It was his opinion that with the fall of the Berlin Wall and the collapse of Communism, any serious competition for liberal democracy and the market economy should no longer exist. Not that history would stop being written, but that the great ideological and geographical struggles would be replaced by commerce and international relations. This change would be primarily concerned with economic matters and no longer with politics or strategy, thus reducing the chance of a large-scale international violent conflict. Of course, at that time, the Soviet Union was dissolving, China’s economy was less than 1/10th of its present size, and Vladimir Putin was a mere KGB agent.

In the intervening decades, the former Eastern Bloc countries, as well as the presumed Communist ones in Asia, have all become enmeshed in the global economy. In many cases, they are taking lead positions in global commerce. Former Soviet satellite states joined the European Union and Russia itself became a key provider of commodity exports, especially energy and metals, making it nearly indispensable for its clients. Globalization helped to grow the global economy and temper inflationary pressures. China led as being the most significant participant and beneficiary.

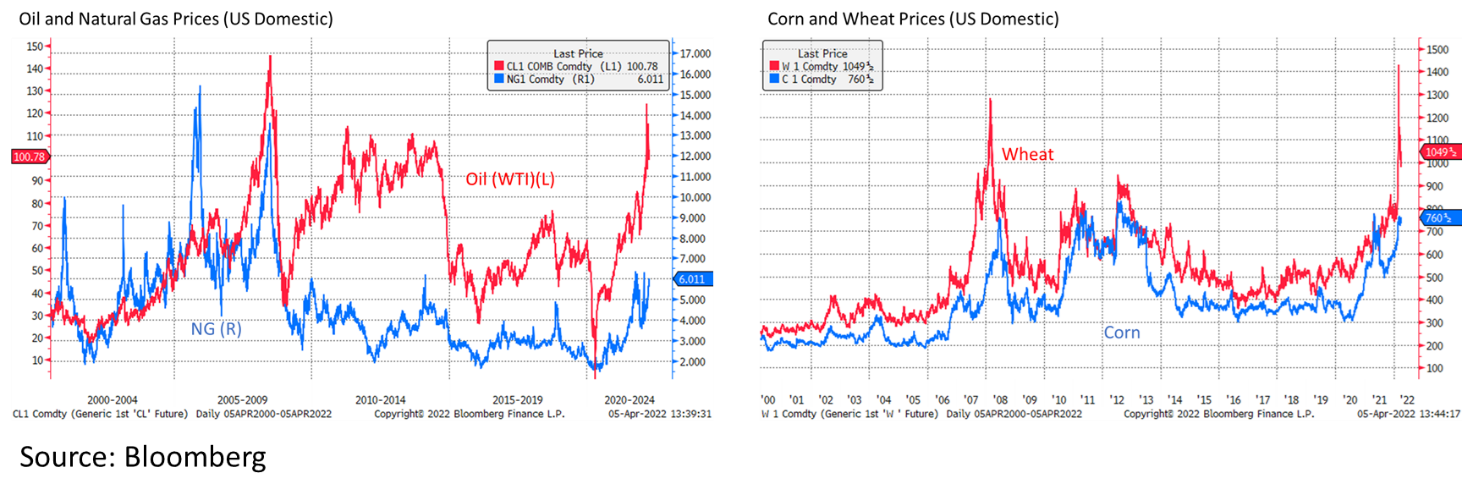

The war has changed all of this and threatens to push Europe into recession as it copes with excising – or at least reducing – its dependence on Russia. The longer the war lasts the greater the impact from disruptions and sanctions. Ukraine and Russia are significant sources of grain production and taking that off-line will have global ramifications.

The End of “The New Normal”?

The immediate impact of the war has been an acceleration of price pressures from commodity markets, particularly oil and gas. Supplies have become diverted and metals and grains, as key supplies, become less reliable. Obtaining additional sources from other producers has become challenging, in part, due to a years-long decline in investments in fossil fuels and the reluctance of OPEC members to increase output. The decline of pandemic-era economic shutdowns has boosted demand just as already constrained supply lines face new obstacles. Coupled with the hangover from ultra-loose monetary policy and fiscal largesse to cushion the effects of the pandemic, inflationary pressures have risen to a level not seen in 40 years.

The challenge for the Federal Reserve and other Central Banks is in determining how much of the rise in inflation is the result of supply shocks from the pandemic and lack of production and, more presently, the war in Ukraine. A year ago, the Fed was convinced that inflation would be transitory as supply shocks would pass and not become entrenched. Both our Central Bank and the markets believed new rate hikes would not take place until 2023—an outlook we did not share. As inflation has continued to rise and lead to additional price increases beyond goods and into services, the risk of inflation becoming entrenched has grown. Wages have begun to rise and, while still lagging the general CPI index, create the possibility that inflation will become inertial.

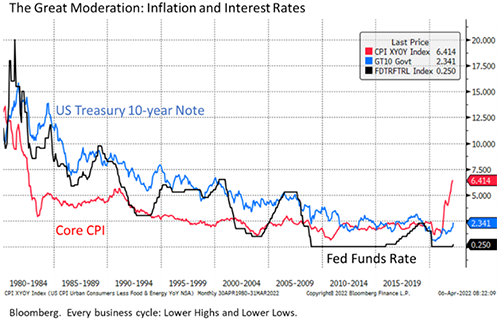

The period from the early 1980s until recently has often been described as “The Great Moderation” as inflation and interest rates fell, in tandem, on a trend basis. This has been attributed to many factors: the ageing of the population; related decline in the long-term growth rate; decline in unionization; offshoring production to lower cost producers (globalization); automation; and better monetary policy management.

These trends became so persistent that in the aftermath of the Global Financial Crisis, the imposition of a zero interest-rate policy, and the advent of quantitative easing (bond buying to lower long rates), new terms were coined to describe the environment. First, there was “Secular Stagnation” followed by “The New Normal” which described an economy with persistently lower growth, inflation, and interest rates. These trends started in Japan in the 1990s and then took over in Europe where negative interest rate policies have become common. As the US economy also experienced the same evolution, many economists and policymakers assumed that it was an inevitable product of an ageing population and a mature developed economy.

The lack of inflation following the extraordinarily easy monetary policy in the aftermath of the Financial Crisis may have convinced policymakers that they had more policy latitude than they did. A pandemic-related round of zero rates and an unprecedented period of quantitative easing, coupled with unprecedented fiscal support, flooded the economy with liquidity. That liquidity showed up in improved balance sheets for consumers, as well as all-time low interest rates on various bonds from investment-grade corporates and high yield as well as for mortgages. Low rates kindled demand for consumer goods and housing, and eventually a broad increase in prices. This environment also, of course, fueled a rise in equity prices which, as a long-term hedge against inflation, makes at least some sense.

The End of Easy Money: Higher Interest Rates and Quantitative Tightening

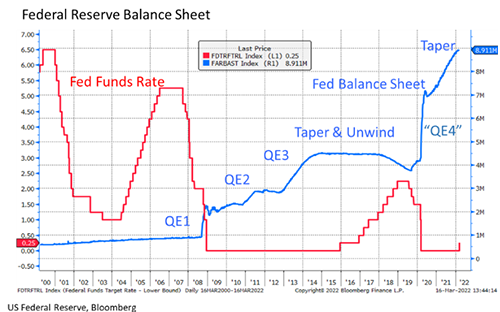

In March, the Federal Reserve increased its official over-night policy rate (Fed Funds) to 0.25%-0.50% and ended its latest Quantitative Easing (QE) program. As inflation has remained elevated, the Fed has since signaled that it will likely accelerate the pace of rate hikes and will begin to proactively wind down its balance sheet (securities it acquired through QE). This “Quantitative Tightening” will be a first as previous balance sheet reductions took place naturally through allowing bonds to mature and managing whether they should be reinvested. The last time the Fed ceased a QE program, it waited two years before allowing any of the holdings to unwind. Presently, the Fed appears to be poised to take a much more aggressive approach, potentially actively selling some securities into the market.

The bond market reacted swiftly as Q1 turned out to be the worst quarter for bonds on record. The 10-year Treasury yield moved .90% higher in Q1, pushing all bond returns negative, with longer duration bonds performing worse than shorter-duration bonds. There is a growing expectation that the Fed’s next move in May will be .50%.

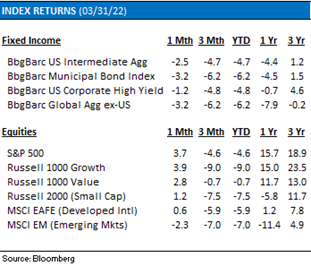

Inflation fears and rising rates also proved to be a difficult backdrop for equities. The S&P 500 recorded its worst January since the financial crisis and the Russian-Ukraine war only added to the calamity – helping push the index down 13% (peak-to-trough) by early March, while other U.S. equity segments (Growth, Small Cap) did even worse. A relief rally in March, following the Fed meeting and positive news on the war, helped markets rebound by quarter-end. While the S&P 500 finished Q1 down 4.7%, the worst quarterly return in 2 years, it did manage to rally 5.6% from February 24th, the day that Russia invaded Ukraine.

Skyrocketing rates hurt long-duration growth stocks. The Russell 1000 Growth index fell 9% in the quarter, more than 8% below the Russell 1000 Value index. Q1 represents the largest outperformance of Value vs. Growth stocks in more than 20 years. The Energy sector (40%) had its best quarter since 1990. Rising rates provided a tailwind to Financials and the risk-off trading environment propelled the Utility sector higher. These are groups that are favored in this environment, and they are all Value stocks.

Small Cap stocks (-7.5%) would seemingly perform better in a world where a global conflict is creating such volatility, however, they are more sensitive to higher borrowing costs, making them vulnerable when inflation is high, and rates are rising.

Developed International (-5.9%) and Emerging Market (-7.0%) equities underperformed the U.S. Investors worried that ongoing sanctions would have a disproportionate effect on European and Emerging economies given their stronger economic ties to Russia and Ukraine.

End of the safety net: Investing in a world of rising rates

Investors are faced with a new challenge not seen in over 40 years – how to manage money in a world of rising interest rates. The secular decline in interest rates that began in the early 1980s has been a tailwind for equities and bonds alike. The financial crisis in 2008 and the COVID pandemic in 2020 then pushed them to nearly zero. In the future, this tailwind is likely to become a headwind, and investors need to adjust accordingly.

From an economic perspective, the Russia-Ukraine war has not created a new set of problems, it is piling on existing ones. First, trade disputes and the COVID pandemic had already begun to threaten global trade – this conflict will undoubtedly accelerate that. Second, supply chain bottlenecks, tight labor markets, and rising crude prices were all a by-product of the pandemic and left unresolved before the conflict. Economic sanctions and a move away from Russian oil supplies will add to inflationary risk, especially in the Eurozone. It seems inevitable that we are facing higher inflation for longer. This puts greater pressure on the Fed to move rates higher, and more quickly, than the market anticipated just a few short months ago.

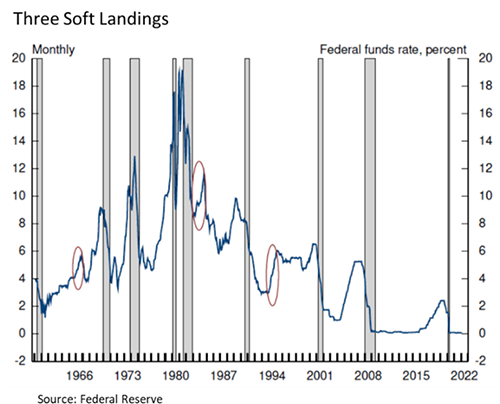

A strong economic outlook is necessary to offset inflation and The Fed’s ability to normalize interest rates is critical. It would be ideal if the Fed succeeded in taming inflation without pushing the economy into a recession. Such a “soft-landing”—as it is called—is no mean feat. In fact, the Fed has only succeeded this on three previous occasions.

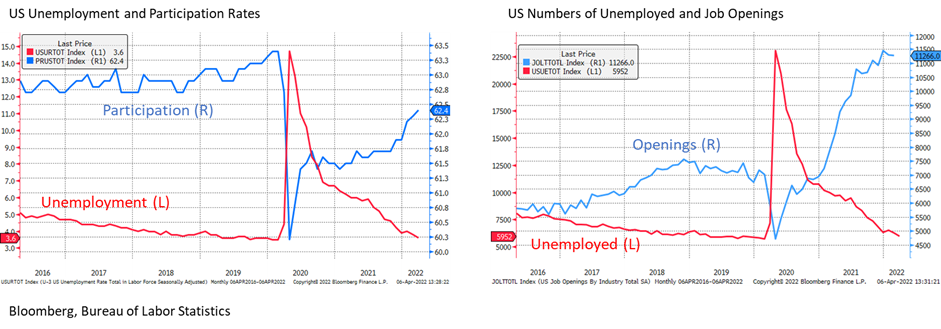

The red circles in the chart show periods in which the Fed increased the Fed Funds rate and did not subsequently produce a recession (represented by the grey shaded areas). There is a reason to hope this will be the case and back to the 90s nostalgia. In the mid-1990s, the consumer was also in good shape with a savings rate that was relatively high, though declining, just as now. Debt to disposable income was relatively low, if rising. Today’s rate is higher than at that time and has been declining steadily over the past 20 years. The interest burden is also lower today. The labor participation rate was rising as it is presently, and unemployment was trending down. Of course, the present labor market appears too tight, and this is presenting a challenge for Fed policy with 1.8 jobs available for every out of work person. The question is how this will be resolved: fewer jobs, likely due to an economic slowdown or more employable people as participation continues to recover. If this happens with higher wages, then it’s inflationary. If it happens because it was due to Covid, then that would affirm the Fed’s original call that the wage inflation, at least, would be transitory.

The implication for investors is enormous. Periods of rising inflation with slow growth (stagflation) typically translate to poor returns across most asset classes. Risky assets perform the worst with only the most conservative fixed income securities performing well. When rising inflation is paired with high growth, economic activity is strong, and companies can pass through higher costs to consumers. This is usually an attractive environment for most equities and bad for bonds.

The implication for equity segments is similar. A low rate, slow growth economy is good for Growth stocks. Rising inflation and strong economic growth is good for traditional Value sectors. A more permanent move to higher inflation would benefit Value stocks, an asset class that is already considered cheap relative to other equity categories.

So how does a market, faced with so many questions, trade only 6% below its all-time high? Because post COVID, the economy entered the malaise from a position of strength. Second, for long-term investors, tighter monetary policy doesn’t have to be a death sentence. Interestingly, a recent Blackrock study measured asset class performance following the first rate-hike of the last 6 tightening cycles (dating back to 1983). Blackrock discovered that the average return for equities after the first rate-hike far exceeded bonds over the following one, two, and three-year periods. The outperformance was even greater for Value stocks for the same periods.

The risk of a global economic slowdown is growing. Higher interest rates, stickier inflation, higher commodity prices, and further supply chain disruptions could lead to muted returns for equities and bonds.

According to FactSet, both the number of companies reporting positive earnings surprises and the magnitude of the positive surprises are below the 5-year average and 10-year average. Consensus earnings estimates for Q1 2022 are now 4.5%, down from 5.7% as of December 31, 2021. The primary headwind for U.S. equities is more the Fed than other factors. With the outlook for other asset classes suspect, we remain constructive on U.S. equities until investor sentiment deteriorates.

The growth outlook in international stocks, primarily in Europe, has declined in the last month due to the war and the dramatic increase in commodities. The region’s reliance on Russian oil threatens economic growth if sanctions run deep. Cheap valuations, and the possibility of a relief rally if resolution comes to pass, keep us neutral for now.

While we expected a weakening in the bond market and advocate an under-weight to fixed income and a focus on shorter duration (interest rate sensitivity) securities, the pace of the sell-off has been remarkable. It remains to be seen how much additional downside there will be in the bond markets as the Fed hikes rates and unwinds its balance sheet. Quite a bit has already taken place. On a positive note, the repricing of bonds is presenting possible investment opportunities where previously record low rates were simply unattractive. At some point, additional weakness in fixed income markets will present a compelling reinvestment opportunity.

Products offered by Wealth Advisory Services, Heartland Retirement Plan Services, and Fiduciary and Trust not FDIC Insured, are not bank guaranteed and may lose value.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. The investment return and principal value of investment securities will fluctuate based on a variety of factors, including, but not limited to, the type of investment, amount and timing of investments, changing market conditions, currency exchange differences, stability of financial and other markets, and diversification. The statements and opinions expressed in this article herein are those of the author as of the date of the article and are subject to change. Content and/or statistical data may be obtained from public sources and/or third party arrangements and is believed to be reliable. This information discusses general economic and market activity and is presented for informational purposes only and should not be construed as investment advice. Views and opinions expressed herein do not account for any specific investment objective, restrictions, and/or financial circumstances of any specific client. Investors are urged to consult with their financial advisors before buying or selling any securities.